Planning for retirement is one of the most important financial goals in life. Whether you live in a developed country or an emerging economy, the principles of retirement planning remain remarkably similar. The goal is to build enough financial security to maintain your desired lifestyle when you stop working. This requires thoughtful planning, disciplined saving, and smart investment strategies that can adapt to your circumstances.

This article outlines practical retirement planning strategies that can be applied globally, regardless of location or income level. It focuses on universal principles that help individuals achieve financial independence and peace of mind in their later years.

1. The Importance of Retirement Planning

Retirement is not just about quitting your job; it is about achieving financial freedom. Without proper planning, many people face the risk of running out of money or relying heavily on family or government support.

1.1 The changing landscape of retirement

Life expectancy is increasing across the world, which means people are spending more years in retirement than ever before. At the same time, traditional pension systems are under pressure in many countries, and the responsibility for funding retirement now falls more heavily on individuals.

1.2 The benefits of early and consistent planning

Starting early allows you to benefit from compound growth. Even modest contributions made regularly can grow significantly over time. Consistency is just as important as timing; saving a fixed amount each month builds long-term stability and resilience against market fluctuations.

2. Setting Clear Retirement Goals

Without clear goals, it is difficult to design an effective retirement strategy. Defining what retirement means to you will determine how much money you need and how you should invest.

2.1 Estimating future expenses

Start by estimating your expected living costs during retirement. Include:

- Housing (rent, mortgage, or maintenance)

- Food, healthcare, and transportation

- Travel, leisure, and hobbies

- Family support or charitable giving

A common rule of thumb is that you may need about 70 to 80 percent of your pre-retirement income to maintain a comfortable lifestyle. However, this varies depending on lifestyle and country of residence.

2.2 Determining your retirement age

The earlier you plan to retire, the more savings you will need. A later retirement age allows more time for savings to grow and fewer years to fund expenses. Choose a target age that balances your financial capacity with your personal goals.

2.3 Setting a savings target

Financial planners often recommend saving 10 to 20 percent of your income for retirement. However, the right amount depends on factors such as expected expenses, investment returns, and social security benefits. Use retirement calculators or professional advice to estimate your target figure.

3. Building a Strong Retirement Savings Foundation

Saving regularly is the foundation of retirement planning. Regardless of where you live, a disciplined approach to saving makes a significant difference over time.

3.1 Pay yourself first

Treat retirement savings as a fixed expense. Automate transfers from your income to your savings or investment accounts each month before spending on other items. This habit ensures consistent progress.

3.2 Use tax-advantaged accounts where available

Many countries offer special accounts that provide tax benefits for retirement savings. Examples include:

- 401(k) or IRA accounts in the United States

- RRSPs and TFSAs in Canada

- NPS or EPF in India

- Superannuation funds in Australia

If such programs are unavailable in your country, you can still create your own structure by saving in diversified investment accounts.

3.3 Keep an emergency fund

Before focusing on long-term investments, build an emergency fund equal to at least three to six months of living expenses. This prevents you from dipping into retirement savings when unexpected costs arise.

4. Investing for Long-Term Growth

Savings alone are not enough to secure a comfortable retirement. To protect against inflation and increase wealth, your money must grow through prudent investing.

4.1 Diversify across asset classes

A well-diversified portfolio typically includes a mix of:

- Stocks or equities for long-term growth

- Bonds or fixed income for stability and income

- Real estate for tangible asset exposure and potential appreciation

- Cash or short-term instruments for liquidity and safety

The right balance depends on your risk tolerance and time horizon. Younger investors can afford more exposure to equities, while older individuals may prefer safer, income-generating assets.

4.2 Regular portfolio rebalancing

Over time, market fluctuations can distort your asset allocation. Rebalancing once or twice a year ensures that your portfolio stays aligned with your goals and risk level.

4.3 Avoid emotional investment decisions

Markets will rise and fall, but emotional reactions can harm your long-term results. Stay focused on your plan and avoid making impulsive decisions based on short-term market events.

4.4 Consider global diversification

Investing across countries can reduce risk and improve potential returns. If possible, include international mutual funds or exchange-traded funds (ETFs) to access global opportunities.

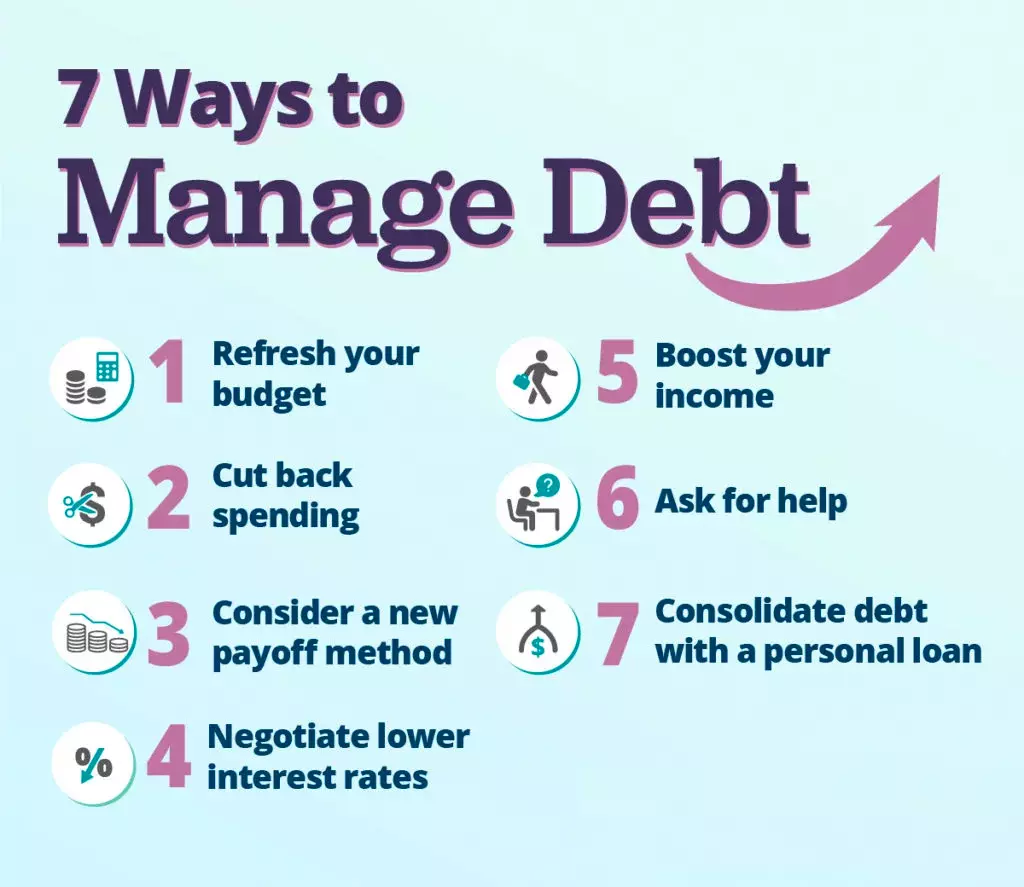

5. Managing Debt and Expenses Before Retirement

Entering retirement with minimal debt gives you greater freedom and peace of mind. Managing expenses effectively ensures your savings last longer.

5.1 Pay off high-interest debts

Before retirement, focus on eliminating high-interest loans such as credit card balances or personal loans. Reducing interest payments frees up cash for savings and investments.

5.2 Plan for healthcare costs

Healthcare expenses tend to increase with age. Explore health insurance options, government programs, or dedicated medical savings plans to avoid financial strain later in life.

5.3 Downsize or relocate strategically

If maintaining a large home is expensive, consider downsizing or relocating to an area with a lower cost of living. Many retirees move to smaller cities or countries where living costs are lower but quality of life remains high.

6. Creating Reliable Retirement Income

When you retire, your savings must generate consistent income. A well-structured withdrawal strategy ensures your money lasts throughout retirement.

6.1 Combine multiple income sources

Most retirees rely on several income streams, such as:

- Pension or government benefits

- Investment income from dividends and interest

- Rental income from real estate

- Part-time work or consulting

Relying on multiple sources provides stability and reduces the risk of outliving your savings.

6.2 Follow a sustainable withdrawal plan

A commonly recommended approach is the “4 percent rule,” which suggests withdrawing about 4 percent of your retirement portfolio annually. Adjust the amount based on inflation and personal circumstances.

6.3 Protect against inflation

Inflation gradually reduces purchasing power. To combat this, maintain some exposure to growth assets like equities, even in retirement. Consider investments that offer inflation-linked returns such as real estate or inflation-protected bonds.

7. Review and Adjust Your Plan Regularly

Retirement planning is not a one-time exercise. Review your plan at least once a year to account for changing goals, income levels, and market conditions.

7.1 Monitor your progress

Compare your current savings with your target. If you fall behind, consider increasing contributions or adjusting your retirement age.

7.2 Update for life changes

Major events such as marriage, relocation, inheritance, or health issues may require adjustments in your plan. Stay flexible and adapt to new circumstances.

7.3 Seek professional advice

Financial advisors can help evaluate your strategy, optimize tax efficiency, and suggest adjustments. Choosing a certified advisor ensures objective and well-informed guidance.

8. Conclusion

Retirement planning is a lifelong process that can be successfully managed anywhere in the world with the right approach. The key is to start early, save consistently, invest wisely, and regularly review your progress. Focus on building a diversified portfolio, managing debt, and ensuring multiple income sources for stability. By following these principles, you can achieve financial security and enjoy a fulfilling retirement, no matter where you live.

FAQs

When should I start planning for retirement?

The best time to start is as early as possible. The earlier you begin, the more time your savings have to grow through compounding, reducing the pressure later in life.

How much should I save for retirement?

A common guideline is to save 10 to 20 percent of your income, but the exact amount depends on your lifestyle goals, expenses, and expected retirement age.

What if I start planning for retirement late?

Even if you start late, it is never too late to improve your financial situation. Increase savings, reduce expenses, and consider extending your working years to build more security.

Should I invest in stocks for retirement?

Yes, but with balance. Stocks are essential for long-term growth, but your exposure should align with your age and risk tolerance. Younger investors can hold more stocks, while older investors should prioritize stability.

How can I protect my savings from inflation?

To protect against inflation, include assets that tend to grow over time such as equities, real estate, or inflation-indexed bonds. Keeping all money in cash can reduce purchasing power.