Personal loans can be an effective financial tool when used responsibly. They provide access to funds for emergencies, debt consolidation, or important life events. However, many borrowers make mistakes that can lead to financial stress or unnecessary costs. Understanding these pitfalls and how to avoid them is essential for making informed decisions.

This article explores the top mistakes to avoid when taking a personal loan, offering practical insights and strategies to manage borrowing wisely.

1. Borrowing Without a Clear Purpose

One of the most common mistakes people make is taking a personal loan without a clear objective. Loans should be tied to specific needs rather than impulsive desires.

Key considerations include:

- Defining the purpose: Determine whether the loan is for debt consolidation, medical expenses, education, home renovation, or other urgent needs.

- Assessing necessity: Ask yourself if the expense can be managed through savings or other less costly options.

- Avoiding lifestyle inflation: Using loans for discretionary spending, such as luxury items or vacations, can lead to long-term financial strain.

Example: Borrowing for a high-end gadget may provide short-term satisfaction, but the interest costs could outweigh the benefits if the repayment period is extended.

By clearly identifying the purpose, borrowers can choose the right loan amount and term, minimizing the risk of over-borrowing.

2. Failing to Compare Loan Offers

Many borrowers accept the first loan offer they receive without exploring alternatives. This can lead to higher interest rates, hidden fees, or unfavorable terms.

How to compare effectively:

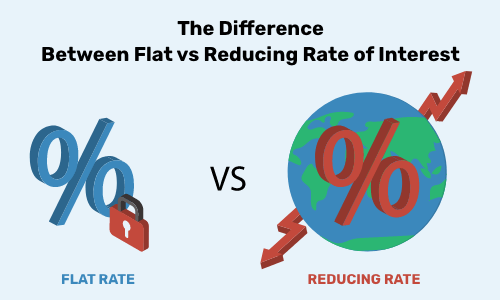

- Interest rates: Compare both fixed and variable rates across different lenders. Even a small difference can impact total repayment significantly.

- Processing and other fees: Consider charges such as processing fees, prepayment penalties, and late payment fees.

- Loan tenure: Assess the repayment period to balance affordable monthly installments with the total interest paid.

- Reputation of the lender: Research the lender’s track record, customer service, and transparency.

Example: If two lenders offer loans of the same amount, one at 10% interest and the other at 12%, over three years, the lower interest rate can save a substantial amount in repayments.

By comparing multiple options, borrowers can secure a loan that is cost-effective and aligned with their financial goals.

3. Ignoring Credit Score and Eligibility Criteria

A strong credit profile can influence the terms of a personal loan, including interest rates and approval chances. Borrowers often overlook the importance of their credit history, which can result in higher costs or rejection.

Mistakes to avoid:

- Applying for loans without checking your credit score

- Ignoring discrepancies in your credit report

- Assuming all lenders have the same eligibility criteria

Actionable steps:

- Obtain a copy of your credit report before applying

- Resolve outstanding errors or debts that may lower your score

- Understand the minimum income, employment, and age requirements of different lenders

Example: A borrower with a credit score of 750 may qualify for a loan at 10% interest, while someone with a score of 600 could face 15% interest. This difference can result in thousands of additional rupees in interest payments.

Taking steps to improve your creditworthiness can lead to better loan terms and reduce financial strain.

4. Overlooking Total Cost of Borrowing

Many borrowers focus solely on the monthly installment without considering the total cost of the loan. This includes interest, fees, and any penalties. Ignoring the total cost can make a seemingly affordable loan expensive in the long run.

Key points to consider:

- EMI vs total repayment: Calculate the total amount to be repaid over the loan tenure, not just the monthly EMI.

- Prepayment and foreclosure charges: Some lenders impose fees for early repayment, which can increase costs if not accounted for.

- Hidden charges: Watch for processing fees, insurance charges, or administrative costs that may not be apparent initially.

Example: A loan of 500,000 rupees at 12% interest over 5 years may have an EMI of around 11,125 rupees. Over the entire period, the total repayment would exceed 667,000 rupees, highlighting the impact of interest over time.

Understanding the total cost ensures that borrowers can plan their budget accurately and avoid surprises.

5. Choosing an Inappropriate Repayment Tenure

Selecting the right loan tenure is crucial. Borrowers often make the mistake of choosing either too short or too long a repayment period, which can affect monthly affordability and total interest paid.

Considerations for tenure selection:

- Shorter tenure: Higher EMIs but lower total interest paid

- Longer tenure: Lower EMIs but higher total interest paid

- Income stability: Ensure that monthly repayments are manageable, even if income fluctuates

Example: A 300,000 rupee loan at 12% interest over 2 years may have an EMI of around 14,100 rupees, whereas a 5-year tenure reduces the EMI to 6,700 rupees but increases total interest substantially.

Balancing tenure with repayment capacity helps borrowers maintain financial stability while minimizing costs.

6. Neglecting Documentation and Terms

Borrowers sometimes underestimate the importance of reviewing the loan agreement and providing accurate documentation. Misunderstanding the terms or submitting incomplete information can lead to delays, higher costs, or legal issues.

Common pitfalls:

- Failing to read terms and conditions carefully

- Ignoring clauses related to prepayment, penalties, or interest adjustments

- Submitting inaccurate or incomplete documents

Practical advice:

- Review the agreement line by line and seek clarification on unclear points

- Keep copies of all submitted documents

- Confirm EMI schedules, interest calculation methods, and due dates

Example: A borrower unaware of a prepayment penalty may end up paying extra fees while attempting to repay the loan early, defeating the purpose of early repayment.

Being diligent with documentation and terms protects borrowers from unexpected charges and legal complications.

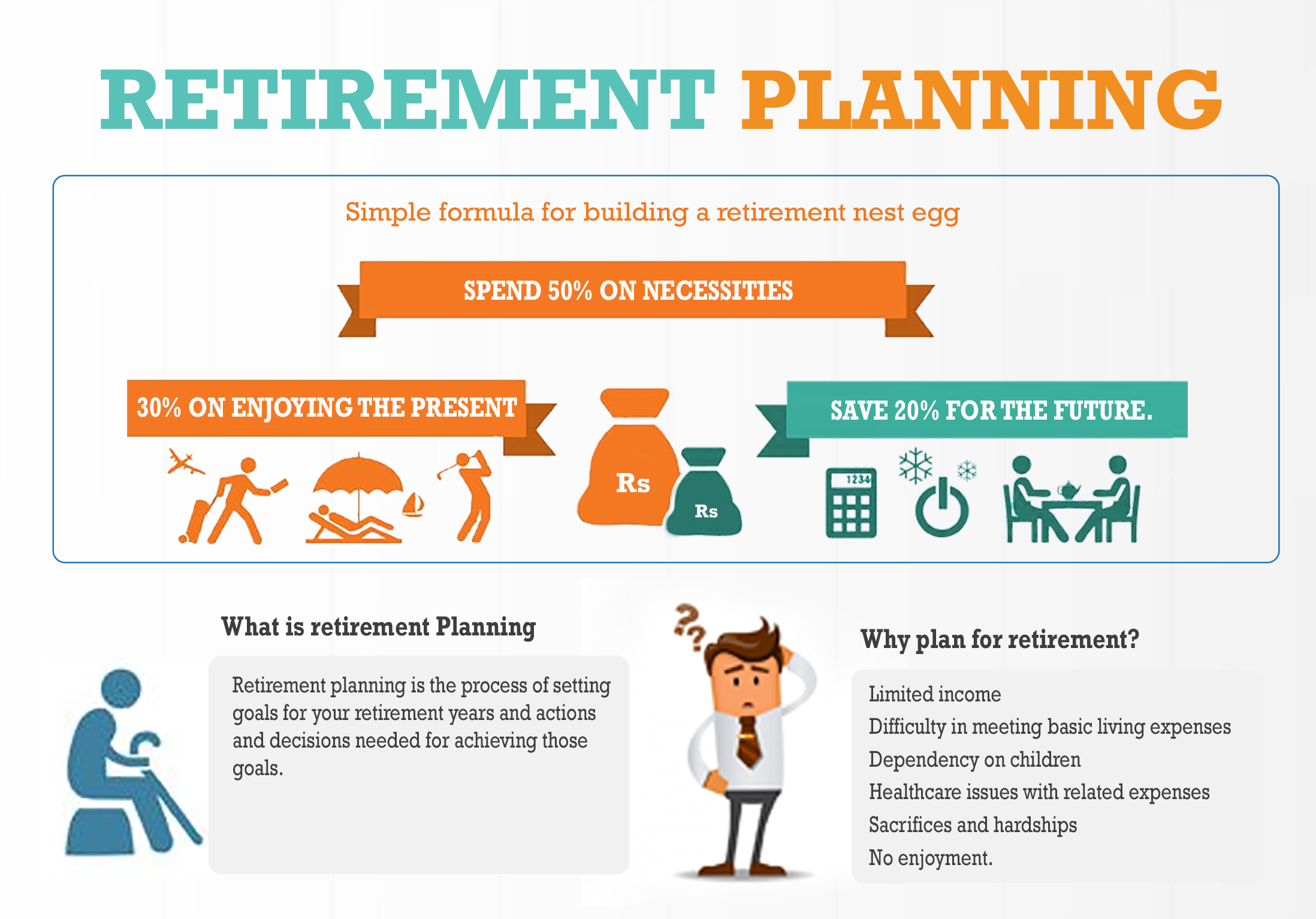

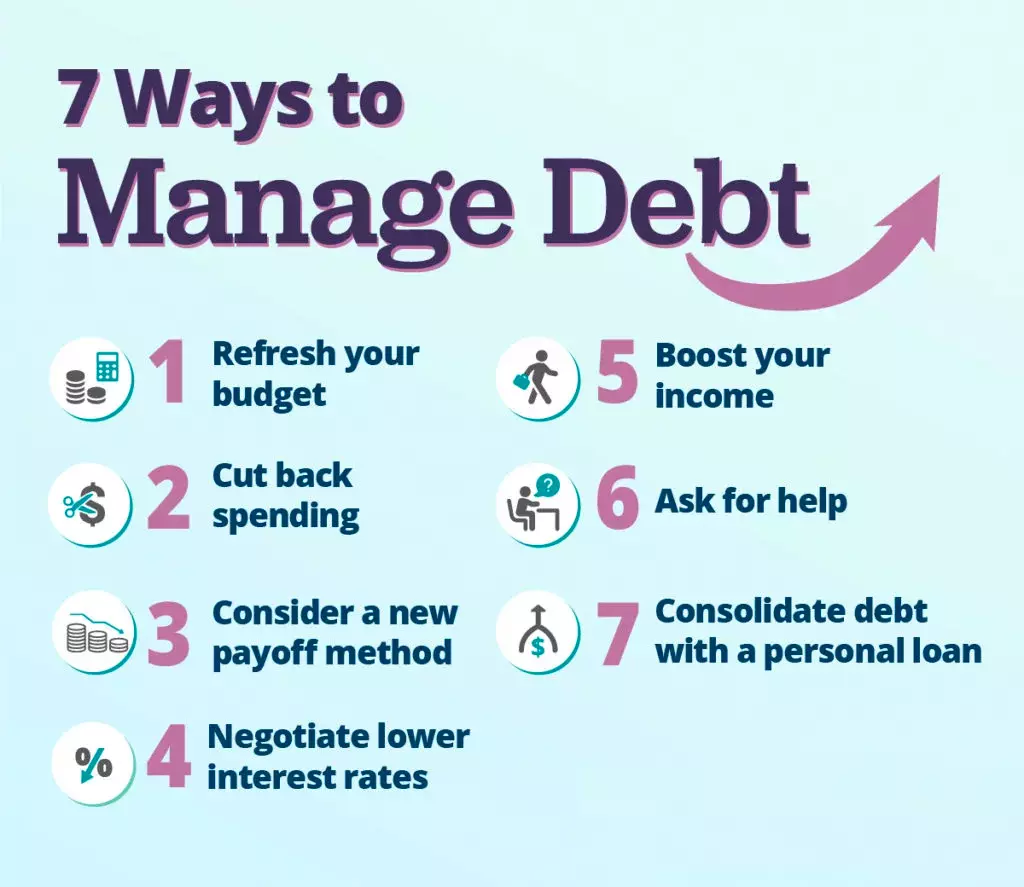

7. Overextending Financial Capacity

Taking a loan beyond your repayment ability is a critical mistake. Overextending can lead to missed EMIs, penalties, and even damage to your credit score.

How to avoid overextension:

- Calculate your monthly budget, accounting for all expenses

- Ensure EMIs do not exceed 30 to 40 percent of monthly income

- Factor in unexpected expenses or emergencies

Example: If your monthly income is 50,000 rupees, committing to an EMI of 30,000 rupees leaves little room for other obligations. This increases the risk of default if an emergency arises.

Responsible borrowing involves balancing your loan obligations with your overall financial health.

Conclusion: Key Takeaways

Personal loans can be a valuable financial resource when approached responsibly. Avoiding common mistakes ensures that borrowing supports your financial goals rather than creating additional stress.

Key takeaways:

- Borrow only for a clear, necessary purpose

- Compare offers and understand all fees before choosing a lender

- Check and improve your credit score to secure better terms

- Evaluate the total cost, not just the monthly EMI

- Choose a repayment tenure that balances affordability and interest costs

- Review documentation and loan terms carefully

- Avoid overextending beyond your financial capacity

By following these guidelines, borrowers can make informed decisions, manage their loans effectively, and achieve financial stability while minimizing unnecessary costs.

Frequently Asked Questions

1. What is a personal loan?

A personal loan is an unsecured loan provided by banks or financial institutions for personal use. It does not require collateral and can be used for purposes such as medical expenses, education, debt consolidation, or major purchases.

2. How is the interest rate on a personal loan determined?

Interest rates depend on factors such as your credit score, income, repayment tenure, and the lender’s policies. Borrowers with higher credit scores typically get lower rates, while those with lower scores may face higher interest rates.

3. Can I prepay or foreclose a personal loan?

Most lenders allow prepayment or foreclosure, but some may charge a fee. Always check the loan agreement for terms related to prepayment to avoid unexpected costs.

4. How much can I borrow through a personal loan?

The loan amount varies based on your income, credit profile, and lender policies. Generally, banks offer loans ranging from a few thousand to several lakhs of rupees.

5. Will taking a personal loan affect my credit score?

Yes, timely repayment can improve your credit score, while missed or late payments can lower it. Excessive borrowing or defaulting can also negatively impact your creditworthiness.

6. Should I choose a fixed or floating interest rate?

- Fixed interest rate: EMI remains constant, providing predictability in monthly payments.

- Floating interest rate: EMI may vary with market rates, which can be beneficial if rates drop but risky if they rise.

7. How do I avoid mistakes when taking a personal loan?

Some practical steps include:

- Define the loan’s purpose clearly

- Compare multiple lenders and offers

- Check your credit score and eligibility

- Understand total repayment costs and fees

- Select a tenure that suits your budget

- Read the loan agreement carefully

- Borrow only what you can repay comfortably