Paying a loan every month can feel like a burden, especially when your EMIs (Equated Monthly Installments) take a large chunk of your income. But what if there were ways to make your EMI smaller without compromising too much? In this guide, we’ll explore practical, easy-to-follow tips to reduce your loan EMI and manage your finances better.

Understanding EMI and Its Components

What is EMI?

EMI stands for Equated Monthly Installment, which is the fixed amount you pay every month to repay a loan. It includes both the principal (the original amount you borrowed) and the interest charged by the lender.

Think of it like splitting your loan into small, manageable slices that you pay monthly. The higher the interest or loan amount, the bigger the EMI.

Principal vs Interest: Breaking Down Your EMI

Your EMI has two parts:

- Principal: The actual loan amount.

- Interest: The cost of borrowing the money.

In the early stages of your loan, a larger portion of your EMI goes toward interest. As time passes, more goes toward repaying the principal.

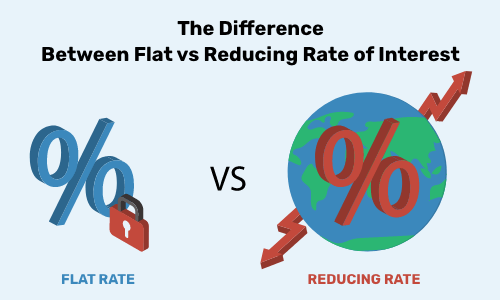

Why Interest Rate Matters the Most

Even a slight change in interest rate can significantly reduce your EMI. A lower rate means less interest over time, which also makes your monthly payment smaller.

Factors That Affect Your EMI

Loan Amount

The bigger the loan you take, the higher the EMI. Simple, right?

Tenure of the Loan

EMI depends heavily on loan tenure. A longer tenure reduces monthly payments but increases the total interest paid over time.

Interest Rate Type: Fixed vs Floating

- Fixed Rate: Stays the same throughout the loan tenure.

- Floating Rate: Changes according to market conditions.

Choosing the right type can impact your EMI directly.

Simple Ways to Reduce Your EMI

Increase Your Loan Tenure Carefully

Extending your loan tenure reduces your monthly EMI but increases total interest. It’s like stretching a rubber band, you reduce tension per month but pay more in the long run.

Opt for a Lower Interest Rate

Always compare rates from different lenders. Even a 0.5–1% reduction in interest can save hundreds or thousands over your loan tenure.

Make a Higher Down Payment

Paying a larger upfront amount lowers your principal, which in turn reduces your EMI. Think of it as cutting the cake before slicing it—smaller slices every month!

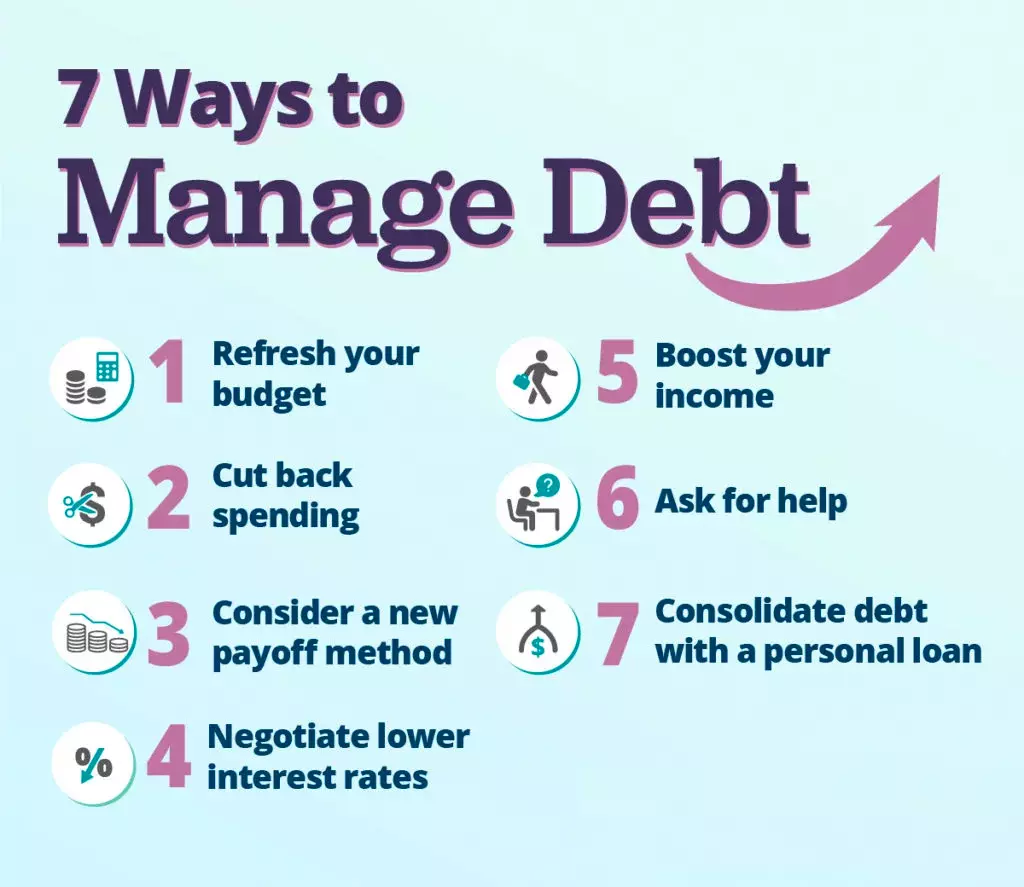

Prepayment and Part-Payment Options

What is Loan Prepayment?

Prepayment means paying part or all of your loan before the due schedule.

How Partial Payments Help Lower EMI

Even partial prepayments reduce the outstanding principal, which automatically reduces your EMI.

Prepayment Charges to Keep in Mind

Some lenders charge a fee for prepayments. Always check the terms, because sometimes the fee might offset the benefit.

Refinancing or Balance Transfer

When Should You Consider a Balance Transfer?

If another lender offers a lower interest rate, transferring your loan can reduce your EMI.

Benefits of Refinancing Your Loan

- Lower monthly payments

- Reduced total interest

- Flexibility in tenure

Possible Pitfalls of Transferring a Loan

Watch out for processing fees, prepayment charges, and hidden terms that can eat into your savings.

Choosing the Right Loan Type

Personal Loans vs Secured Loans

- Unsecured personal loans usually have higher interest rates.

- Secured loans (like home or car loans) offer lower rates, which means smaller EMIs.

Home Loans: Fixed vs Floating Interest

Fixed rates offer stability, but floating rates can save money when market rates drop. Choose based on your financial situation.

Using EMI Calculators to Plan Your Loan

How EMI Calculators Work

An EMI calculator is a simple tool where you enter loan amount, interest rate, and tenure. It instantly shows your EMI.

Testing Different Scenarios

Try multiple scenarios—different rates, tenures, or down payments—to see what combination reduces your EMI most effectively.

Negotiating with Lenders

How Banks Decide Interest Rates

Banks consider your credit score, income, and loan type.

Tips for Negotiating a Lower EMI

- Maintain a good credit score

- Compare offers from multiple lenders

- Be upfront about your financial capability

Avoiding Common Mistakes

Borrowing More Than Needed

Only borrow what you actually need. Extra borrowing increases EMI and interest unnecessarily.

Ignoring Hidden Fees

Always check for processing fees, prepayment charges, or insurance costs. Hidden costs can increase your effective EMI.

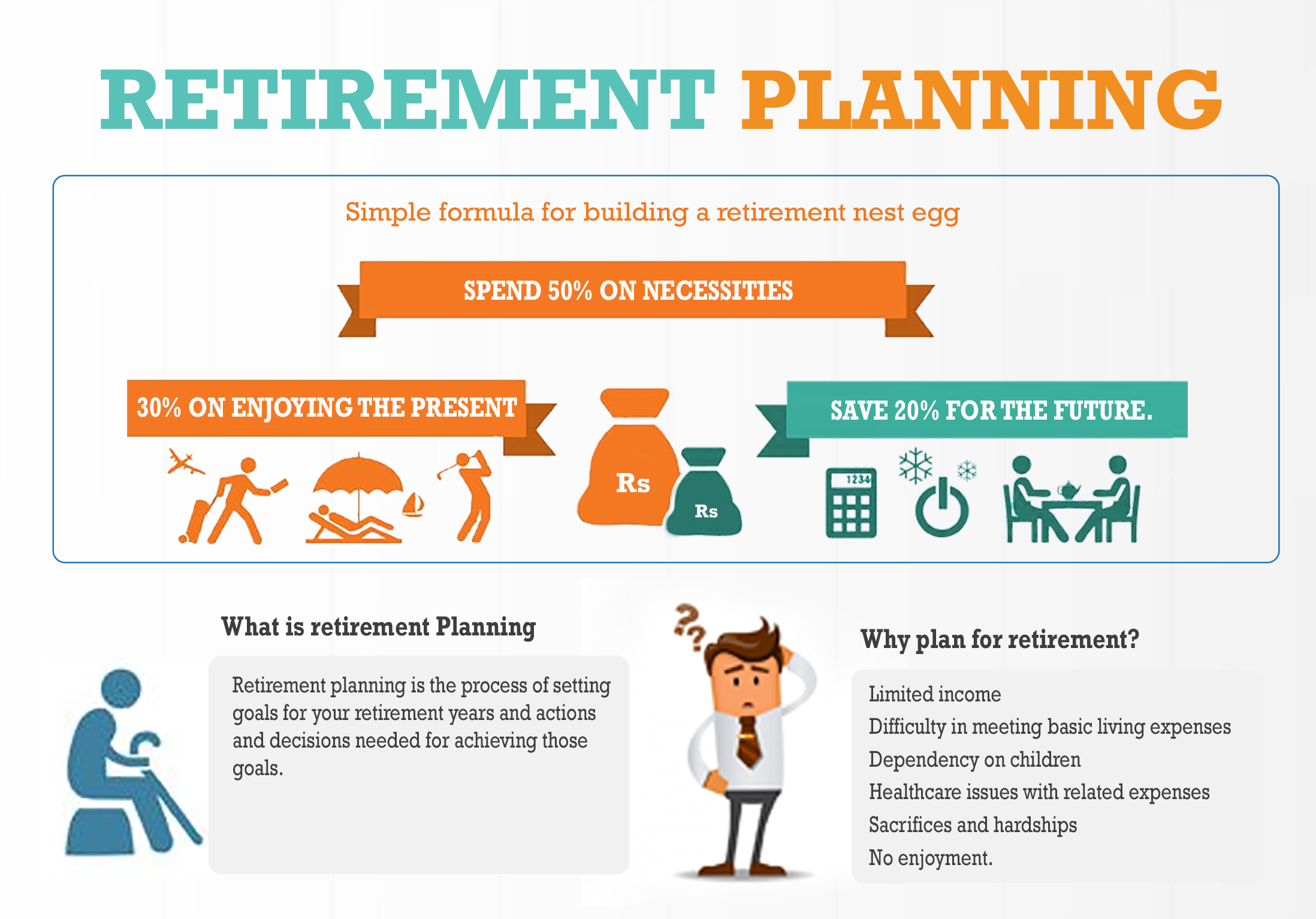

Smart Budgeting to Manage EMI

Allocate Your Income Efficiently

Set aside a fixed portion of income for EMI, savings, and expenses. Treat EMI like a non-negotiable bill.

Automating Payments for Convenience

Automatic payments reduce late fees and help you stay consistent, which indirectly keeps your EMI “manageable” in your financial plan.

Conclusion

Reducing your EMI is not about cutting corners—it’s about smart planning, comparing options, and making informed financial choices. From choosing the right tenure to prepaying wisely or negotiating rates, even small steps can have a big impact. Remember, the goal is to reduce monthly burden while minimizing total interest paid.

FAQs

1. Can I reduce my EMI without extending the loan tenure?

Yes, by prepaying part of the principal or negotiating a lower interest rate.

2. How much difference does prepayment make in EMI?

Prepayment reduces the principal, which lowers the EMI and interest over the loan tenure. The impact can be substantial if done early.

3. Is it always beneficial to transfer my loan to another bank?

Not always. Consider processing fees, prepayment penalties, and hidden terms before making a decision.

4. Can improving my credit score lower my EMI?

Absolutely! A better credit score can get you a lower interest rate, which reduces your EMI.

5. Are there any hidden charges when reducing EMI?

Some lenders charge prepayment fees or processing fees. Always read the fine print before making changes.